Contributed by, Steve Postal, Senior Director, Policy and Regulatory Affairs at National Community Pharmacists Association (NCPA), and Editorial Director of American Society for Pharmacy Law (ASPL)

Under the Medicare Drug Price Negotiation Program (MDPNP), starting this month, the secretary of the Department of Health and Human Services (HHS) has negotiated pricing for the 10 top-spend drugs in Medicare Part D, and will increase the number of drugs negotiated yearly and include Part B drugs by 2028. This is a cumulative list, and should result in 60 negotiated drugs by the end of the decade. This means that effective January 1, 2026, 10 drugs covered under Medicare Part D now have negotiated prices, which the law refers to as maximum fair prices (MFPs). The Centers for Medicare & Medicaid Services (CMS) expects the savings realized in 2026 to lower out-of-pocket costs for Medicare enrollees by an estimated $1.5 billion.1

Community pharmacies are critical to ensure the success of the MDPNP. A study by Avalere Health in March 2025 showed the impact of the MDPNP on independent pharmacies and beneficiaries alike. The study found that 34% of prescriptions (or 74 million prescriptions) slated for the MDPNP for 2026 or 2027 are currently filled at an independent or franchise pharmacy. Avalere defined franchise pharmacies as “independently owned pharmacies that operate under a franchisor’s branding and business model within a specific region.” Additionally, the report found that 30% of Medicare Part D beneficiaries (or 12 million beneficiaries) received at least one of these prescriptions at an independent or franchise pharmacy. The study concluded that it is vital to understand impacts on dispensers and beneficiaries.2

The MDPNP is expected to exacerbate cash flow concerns that pharmacies already have under Medicare Part D. Under Medicare Part D, on average independent pharmacies are paying their wholesalers for drugs they ship to pharmacies approximately every two weeks, with some paying more frequently. Meanwhile, plans and PBMs under Medicare Part D must reimburse network pharmacies (other than mail-order and long-term care pharmacies) under Medicare Part D prompt pay requirements 14 days after which the claim is received for electronic claims, and 30 days after for any other claim.3

But a study published in January 2025 by 3Axis Advisors and commissioned by the National Community Pharmacists Association (NCPA) has projected that pharmacies can expect to experience additional financial strain under the MDPNP. The 3Axis Advisors study found that: 1) pharmacies can expect to face prescription payment settlement delays (in the form of the manufacturer refund payments) of at least seven additional days for negotiated drugs, exceeding current Medicare Part D prompt pay requirements; 2) each pharmacy stands to lose nearly $11,000 in weekly cash flow due to delayed payments; and 3) pharmacies could forfeit an average of $43,000 in annual revenue — roughly equivalent to a pharmacy technician’s yearly salary. The projected $43,000 annual loss is due to the elimination of estimated margins previously yielded on MFP medications relative to estimated MFP-based payments.

And community pharmacists have concerns with the program. In September 2025, NCPA surveyed its members on the MDPNP, and received slightly over 400 responses. When asked if the MDPNP would affect their decision to stock these ten drugs, 86% stated that they were either considering (67%) or have already decided (19%) to not stock the drugs.4

NCPA and its members still have concerns that the MDPNP payments to community pharmacies, both PBM and plan reimbursement and manufacturer refund amounts, will be untimely and insufficient. Regarding the manufacturer refund, we are concerned that these amounts may not be what CMS recommends them to be: the standard default refund amount (SDRA) of wholesale acquisition cost (WAC) minus the maximum fair price (MFP) of the drug. As of this writing, only two manufacturers have committed to refunding pharmacies at the SDRA.

Secondly, community pharmacies are concerned that the manufacturer refund payment will not be made timely, and are asking manufacturers to provide those refunds within 14 days of adjudicating the claim. So far, no manufacturers has made such a promise, although redacted language that CMS published on the manufacturer effectuation plans shows efforts of some manufacturers to speed up payment.5 Given that community pharmacies pay their wholesalers on average every two weeks, any low payment of and/or delay in manufacturer refunds will cause significant financial cashflow concerns.

Additionally, pharmacies are worried that reimbursement from PBMs and plans will be insufficient, and are arguing that they be paid from PBMs and plans no less than MFP plus a dispensing fee commensurate with Medicaid fee-for-service, and that PBMs/plans cannot assess any direct or indirect renumeration (DIR) fees on these drugs.

Long-term care pharmacies have additional concerns about the MDPNP, as the program will have a disproportionate effect on long-term care pharmacies with more than half predicting challenges dispensing critical medication. A study of long-term care pharmacies found that: 60% would be forced to close pharmacy locations; 91% would be forced to lay off pharmacy staff; 85% would be forced to limit essential services; 82% would be forced to shift costs to LTC customers, and 56% would be challenged to dispense certain medications.6

Pharmacies need to closely review their contracts with PBMs and plans, and consult with their PSAO if applicable, to see if PBMs and plans are requiring them to dispense drugs under the MDPNP. Any such requirement from PBMs and plans will govern, despite CMS stating that they will not require such dispensing in an updated FAQ7 and letter.8

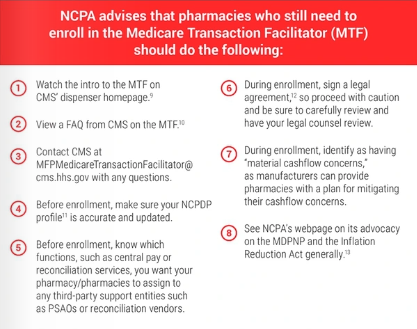

Enrollment has no hard deadline and will be available after January 2026. It will take approximately one hour and will require providing banking information.

Additionally, pharmacies will need to enroll in the Beacon platform, which all manufacturers will use where dispensing entities can access additional details regarding MFP effectuation and refund status, and be able to communicate with manufacturers on good-faith inquiries related to MFP effectuation for specific claims. Beacon is a free, web-based platform.

Additional CMS resources include:

• A CMS pharmacy toolkit14 on the Medicare Transaction Facilitator (MTF) of the Medicare Drug Price Negotiation Program (MDPNP). This resource includes a link and instructions to enroll, other resources for pharmacies, and reminders about how to keep your NCPDP data up to date.

• A CMS webinar15 to NCPA members on enrollment in the Medicare Transaction Facilitator (MTF).

• Various CMS MTF resources, including the Medicare Transaction Facilitator Enrollment Quick Guide to the CMS Help Desk website under the Browse Resources section.16 This resource is designed to assist pharmacies, other dispensing entities, and third-party support entities with the MTF enrollment process.

References:

1 Medicare Drug Price Negotiation Program: Selected Drugs for Initial Price Applicability Year 2027. CMS January 2025.

2 Impact of MFP Effectuation on Pharmacies and Beneficiaries. Avalere Health 14 Mar 2025.

3 42 CFR 423.520(a)(1).

4 See Report for Medicare Drug Price Negotiation Program and Financial Health of Pharmacy. NCPA Sept 2025.

5 See Some details of manufacturer plans under the MDPNP are available. NCPA 02 Oct 2025.

6 See New SCPC Member Survey Shows More than Half of America’s LTC Pharmacies May Close 7 Locations Without Congressional Action. Senior Care Pharmacy Coalition. March 12, 2025.

Medicare Transaction Facilitator: Pharmacies and Other Dispensing Entities Frequently Asked Questions. CMS September 2025.

8 Letter from CMS Administrator Dr. Mehmet Oz to Rep. Buddy Carter. June 23, 2025.

9 Pharmacy and Dispensing Entity Resources. CMS.

10 Medicare Transaction Facilitator: Pharmacies and Other Dispensing Entities Frequently Asked Questions. CMS September 2025.

11 See NCPDP Online. NCPDP.

12 See MTF Data Module User Agreement. CMS.

13 See Inflation Reduction Act: Resources and Advocacy. NCPA.

14 Toolkit: Medicare Transaction Facilitator. CMS.

15 Medicare Transaction Facilitator Enrollment for Dispensing Entities Webinar. CMS, as hosted by NCPA. Available on YouTube.

16 Medicare Transaction Facilitator (MTF) –Resources. CMS.